Ei Rates For 2021

Total amount you remit for EI premiums 46920 You stop deducting employment insurance premiums when you reach the employees maximum insurable earnings 56300 for 2021 or the maximum employee premium for the year 88954 for 2021. CPP contributions for 2021.

Gold Loan With An Emi Option Or Overdraft Facility Which One To Choose Loan Interest Rates Loan Apply For A Loan

Employers EI premium Employee EI premium x 14.

Ei rates for 2021. EI Program Characteristics for the period of June 06 2021 to July 10 2021. Employees maximum insurable earnings for 2021 - General exemption x Employer contribution rate 100 Method 2. This is so that workers and businesses would not face increased costs due to the additional expenses resulting from the.

You have your monthly eligible revenue amounts from the current and previous year. You are calculating a claim for period 5 or later and you understand that the 10 wage subsidy does not apply. The maximum insurable earnings for 2021 is 56300 up from 54200 in 2020.

In 2019 EI rates went down by five cents for employers from 232 to 227. Employee Status Employer EIS Contribution Rate. EI QPIP CPP and QPP contributions.

The tax credits corresponding to the claim codes in the tables have been indexed accordingly. The tax credits corresponding to the claim codes in the tables have been indexed accordingly. Table of EI rates.

This is done with the approval of the Minister of Employment and Social Development ESD. The federal indexing factor for January 1 2021 is 10. Based on local market costs of mid-priced hotels lodging per diem rates provide caps or maximum amounts that can be reimbursed to federal employees for lodging and meals while on official travel.

Annual taxable income From To Federal tax rate R Constant K. By law GSA sets these rates annually. Chart 1 2021 federal tax rates and income thresholds.

Employees gross annual income and. For those who have an end date for your CPP premiums read on. One of the following applies.

Employees will automatically receive the indexing change whether or not they. EI this year is again a bit lower. Employers EI premium The smallest figure between.

For 2021 the federal income thresholds the personal amounts and the Canada employment amount have been changed based on changes in the consumer price index. 1 Seasonal and Weighted Supply Price Information may change slightly beginning in February June and October due to scheduled changes in the Rider 8 and Rider 1 Adjustments and Transmission charges June. EI Premium rate set at 158 of insurable earnings up to 56300 in 2021 from 54200.

Employment Insurance EI Premium Rates The 2021 EI premium rate is 158 per 100 of insurable earnings as announced by the government on August 20 2020 in conjunction with the announcement of 3 new benefits to replace Canada Emergency Response Benefit CERB. Employment Insurance EI The employee and employer rates remain unchanged for 2021 while the maximum insurable earnings increased from 54200 to 56300. The federal indexing factor for January 1 2021 is 10.

Program Characteristics for the period of June 06 2021 to July 10 2021. The premium rate in 2021 for employees covered under the Quebec Parental Insurance Plan QPIP is reduced this year. 158 of insurable earnings to a yearly maximum contribution in 2021 of 88954 The 2020 rate was 158 to a maximum contribution of 85636 Superannuation Pension Contributions.

The 2021 EI 7-year forecast break-even rate is 193 of insurable earnings for residents of all provinces except Qubec. This is the EI maximum insured income for the year. Contact us today with any queries on Contributions or Premiums Entrepreneurship of some kind has become a way of life for.

Here are the different EI premium tables for the last 3 years. Year Maximum annual insurable earnings Rate Maximum annual employee premium Maximum annual employer premium. There is a change in pension contributions for all employees as per the rates below.

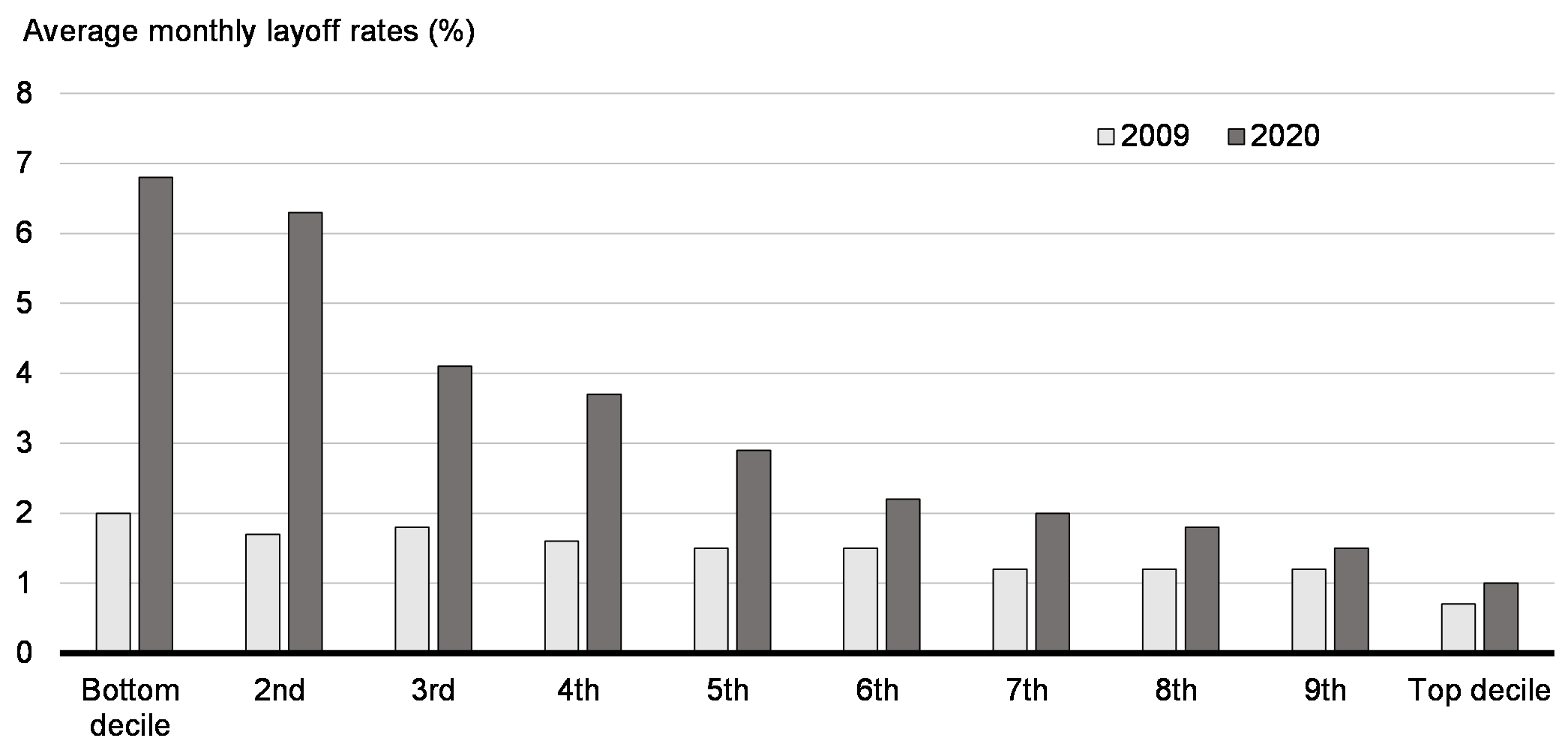

For 2021 the federal income thresholds the personal amounts and the Canada employment amount have been changed based on changes in the consumer price index. This represents a significant increase from the 2020 break-even rate of 158 and is the result of the situation created by the COVID-19 pandemic. The EIS contribution rate is shown in this EIS table 2021 Table does not apply to new employees aged 57 and over who have not previously made a contribution.

The Meal and Incidental Expense MIE per diem tiers for FY 2021 are unchanged at 55-76. 25 Zeilen Federal EI premium rates and maximums.

Sightseeing In Chisinau Chisinau Moldova Travel Chisinau Moldova Chisinau

Tiny Rhinestone Crown Tiara Etsy Brocante Kroon

Budget 2021 Low Wage Workers Canada Ca

Gmail Sign Up Create New Gmail Account Free Google Account Sign Up Mstwotoes In 2021 Gmail Sign Up Gmail Sign Free Email Services

Vuelta 2021 Parcours En Etappes

The 5 Best Monthly Dividend Paying Stocks In 2021 Saving Rates Stocks To Watch Dividend Stocks

Quarterly National Accounts Gdp And Employment Statistics Explained

Importance Of Computer Essay 120 Words In 2021 Essay Writing Tips Essay Words

Vuelta 2021 Parcours En Etappes

Pin By On Serieproduct Amsterdam Theater Architecture Art House Movies

New 7 Eggs Mini Automatic Digital Temperature Control Egg Turning Incubator Hatcher Wish In 2021 Egg Incubator Chicken Eggs Backyard Poultry

Vuelta 2021 Parcours En Etappes

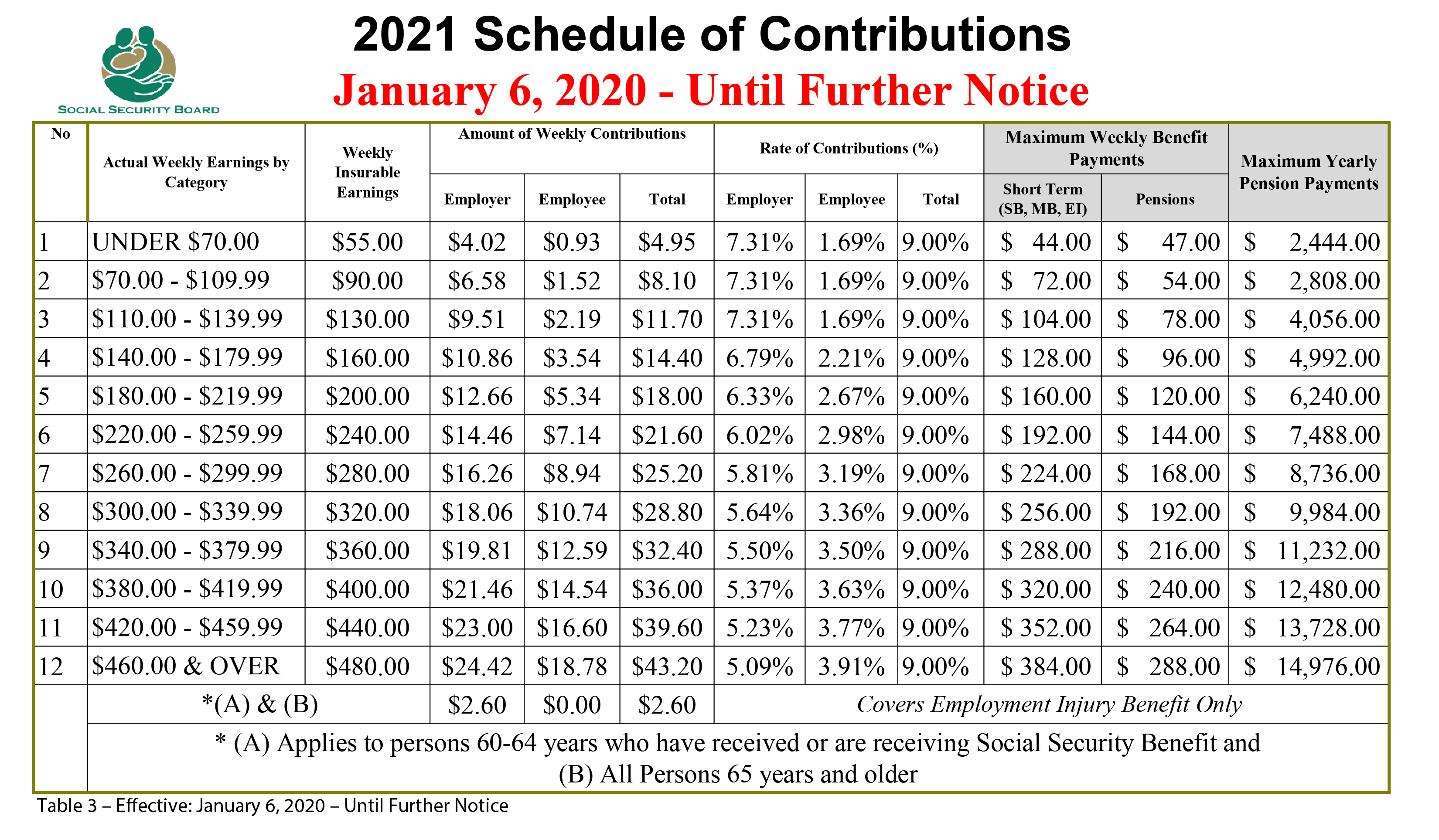

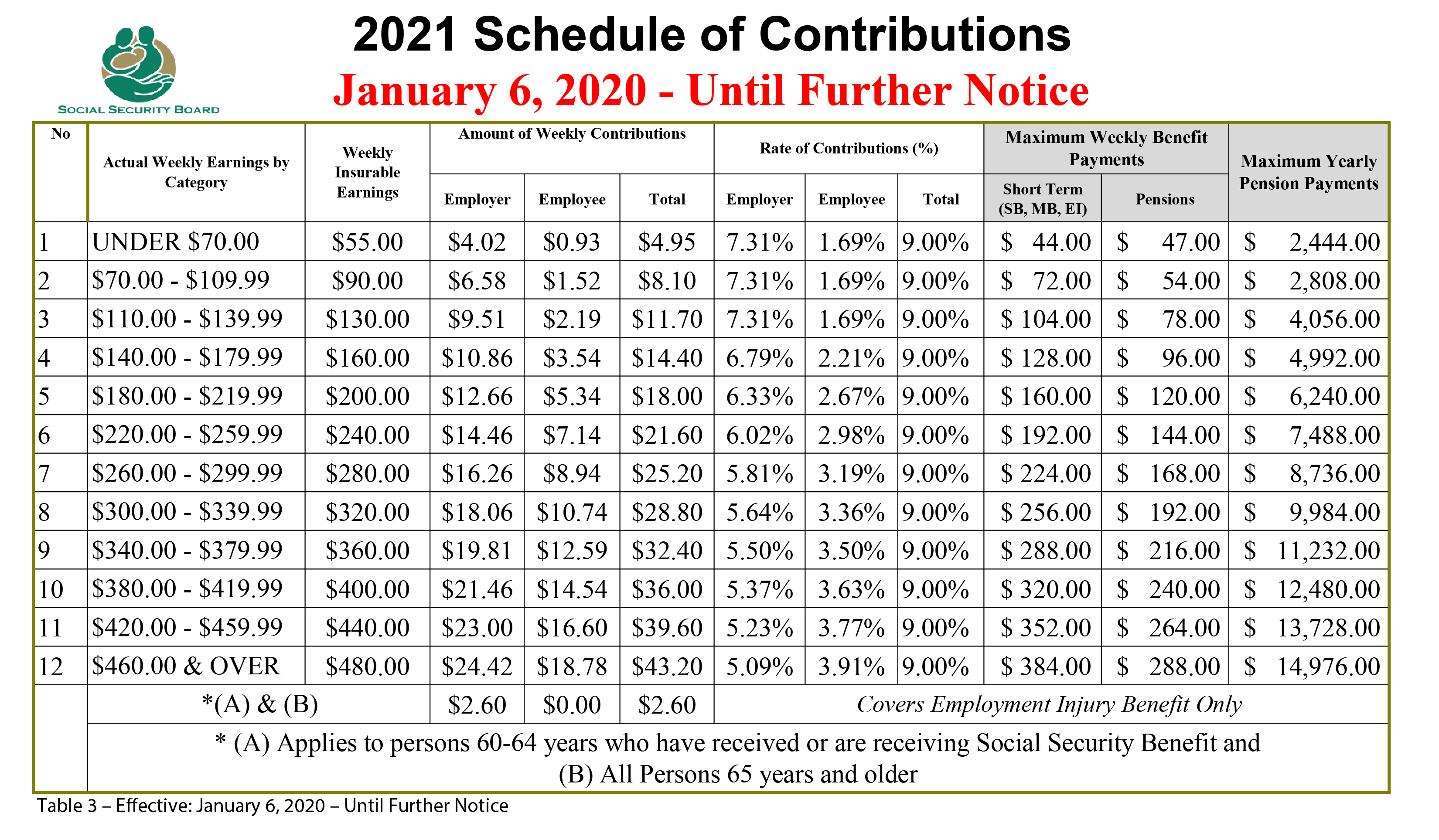

Contributions Social Security Board Belize

Vuelta 2021 Parcours En Etappes

Best High Interest Savings Accounts In Canada For 2021 High Interest Savings Best Savings Account High Interest Savings Account

Vuelta 2021 Parcours En Etappes

Bentley Flying Spur W12 2020 Excellent Luxury Limousine Youtube In 2021 Bentley Flying Spur Flying Spur Bentley

Posting Komentar untuk "Ei Rates For 2021"