Employee Identification Number Uk

You must tell HMRC about your new employee on or before their first pay day. Use IRS Form SS-4 to apply for an EIN.

How To Make A Cpn Number For Free 2019 Online Identity Fraud Build Credit Good Credit

Copy of certificate of incorporation or.

Employee identification number uk. Its usually shortened to ERN and is also known simply as an employer PAYE reference but dont be put off by all the different names they refer to the same number. Information on Tax Identification Numbers Section I TIN Description The United Kingdom does not issue TINs in a strict sense but it does have two TIN-like numbers which are not reported on official documents of identification. Internal Revenue Service Employer ID Numbers Jul 25 2021 An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

HMRC needs your ERN in a number of different circumstances including when you complete your end-of-year PAYE return. ERNs are used when submitting Individualised Learner Records ILR. The accounts office reference number is made up of 13 characters in the following format.

An Employer Registration Number ERN is used to identify the employer and primarily recorded for a learner. It works in the same way a Social Security number does for individuals and almost every business needs one. The format is a unique set of 10 numerals allocated.

The PIN has been the key to flourishing the private data exchange between different data-processing centers in computer networks for financial institutions governments and enterprises. Employer Identification Number EIN A nine-digit number for example 12-3456789 assigned to sole proprietors corporations partnerships estates trusts and other entities for tax filing and reporting purposes. It can take up to 5 working days to get your employer PAYE reference number.

A company including a UK LLP which is not listed on a regulated market such as the London Stock Exchange. Get help from HMRC if you need extra support. If a person decides to open a company of its own his CUIL usually becomes his CUIT.

Employees have a CUIL assigned at the moment the DNI is created and employers have a CUIT. The unique taxpayer reference UTR. When do I need an ERN.

An invalid or missing ERN is one of the most common reasons end-of-year returns are rejected you need this number. The first two digits to identify the CUIT for companies are for instance. A business needs an EIN in order to pay employees and to file business tax returns.

HMRC may ask if you want to add voice identification to. Corporate ID required Individual ID required. Get their personal details and P45 to work out their tax code.

You can use Relay UK if you cannot hear or speak on the phone. Dial 18001 then 0300 200 3300. The remaining digits are a unique reference.

Tell HMRC about a new employee. The Employer Identification Number EIN also known as the Federal Employer Identification Number FEIN or the Federal Tax Identification Number is a unique nine-digit number assigned by the Internal Revenue Service IRS to business entities operating in. The first 3 digits of the employers reference number relate to the PAYE office looking after your account.

Employer Identification Number or EIN is the corporate equivalent to a Social Security number It is issued to individuals entities and any other organization. You can use the online HMRC checker to verify this number. Our vision mission.

An Employer ID Number EIN is an important tax identifier for your business. It is a unique. An EIN is for use only in connection with a taxpayers business activities.

An employer reference number is a unique combination of letters and numbers also called an employer PAYE reference PAYE reference number or just abbreviated to ERN. If your business starts employing people on or. The taxpayer identification number TIN is the unique identifier assigned to the Account Holder by the tax administration in the Account Holders jurisdiction of tax residence.

It is given to a business when it registers with HMRC as an employer serving to identify the employer for employee income tax and national insurance purposes. You cannot register more than 2 months before you start paying people. PINs may be used to authenticate banking systems with cardholders governments with citizens enterprises with employees.

The core enterprise culture. A personal identification number or sometimes redundantly a PIN number is a numeric passcode used in the process of authenticating a user accessing a system.

Last Payslip And W 2 Form Tax Refund Service Estimate Tax Refund Usa Uk Ireland Picture Tax Refund Tax Income Tax

Staff Id Cards Download At Http Mswordidcards Com 10 Best Staff Id Card Templates Id Card Template Card Templates Printable Free Business Card Templates

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark Employer Identification Number How To Apply Tax

Irs Installment Agreement Salem Nh Mm Financial Consulting Inc Paying Taxes Internal Revenue Service Irs

Verifying Your Employer Identification Number Ein Help Center Wix Com

Employee Id Card Templates Microsoft Word Id Card Templates Employee Id Card Id Card Template Employees Card

Business Names Employer Identification Number Social Media Promotion

How To Find Form W 2 Online For 2020 2021 Filing Taxes Online Employer Identification Number

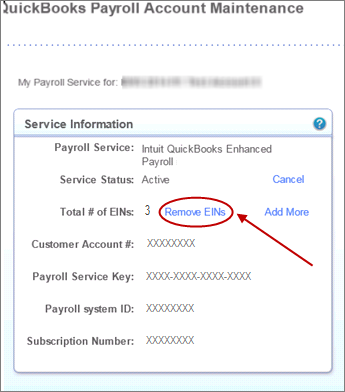

Remove An Employer Identification Number Ein

Fake Bank Statement 2 2 Unconventional Knowledge About Fake Bank Statement 2 That You Can T Confirmation Letter Doctors Note Template Letter Of Employment

Amazon Dolman Bateman Accountants Sydney Business Valuation Employer Identification Number Business Structure

Custom Employee Id Identification Photo Bar Code Badge Zazzle Com Custom Custom Badges Personalised Kids

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

How To Get An Ein From Outside The U S Ofx

Yes You Re In The Right Place If You Need Any Fake Docs Passports Id Cards And Lots More To Get The Addi Lettering State Farm Insurance Letter Of Employment

Letter Ein Confirmation Confirmation Letter Doctors Note Template Employer Identification Number

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Iom Tin Pdf

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Iom Tin Pdf

Usa Ein Irs Letter Template Letter Templates Lettering Templates

Posting Komentar untuk "Employee Identification Number Uk"