Federal Identification Number Same

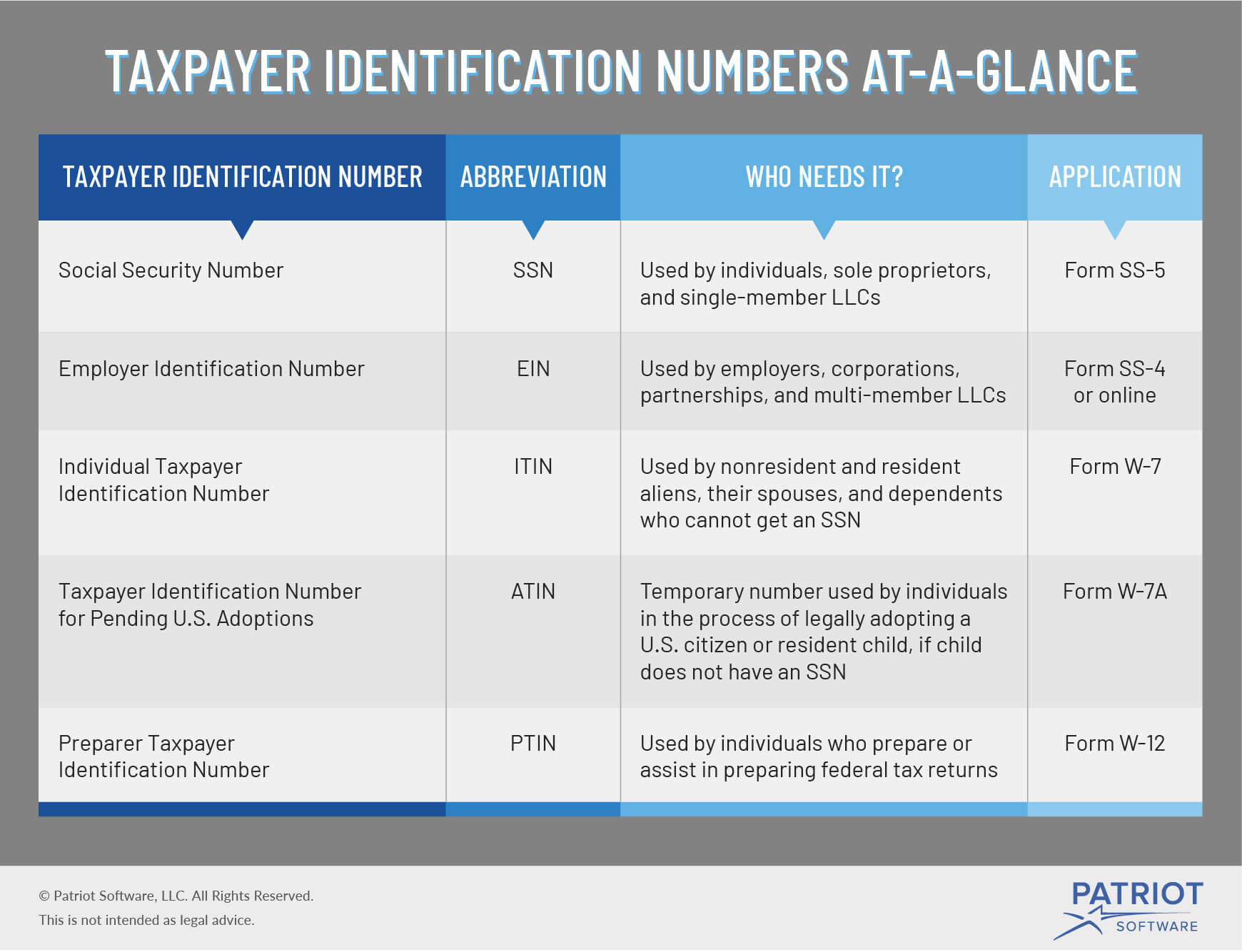

An employer ID number EIN used by businesses for tax purposes is just one type of tax ID number TIN that can be assigned by the Internal Revenue Service IRS for federal income tax purposes. A good rule of thumb is that if you need a tax ID for a Federal purpose ie.

Pin By Appetan On Http Www Appetan Ir Accounting Business Tax Investing

Sales and Use tax or local permits you will need a State-Level State Tax ID Number and NOT an EIN because EINs are always Federal even though a Tax ID can be considered a Federal Tax ID or a State Tax ID.

Federal identification number same. Most 1099-SA forms read PAYERS federal identification number. The first two digits are separated from the remaining seven digits by a dash like 12-3456789. You should apply for an EIN early enough to have your number when you need to file a return or make a deposit.

What is a Tax ID Number. The paper application will take 4-6 weeks to process. Its free to apply for an EIN and you should do it right after you register your business.

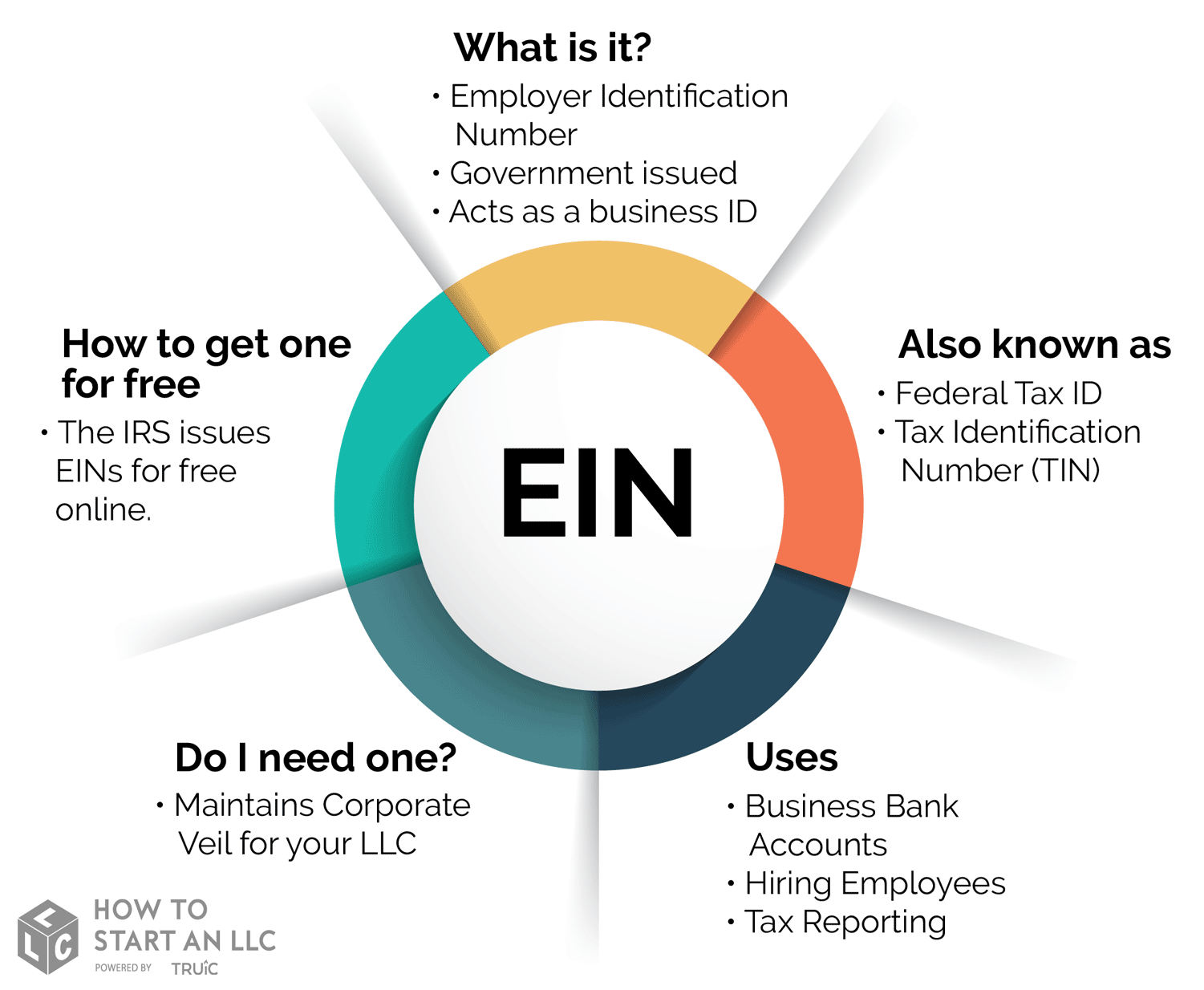

Filing taxes or hiring employees you will absolutely need an EIN Number. Is EIN the same as a Tax ID. Yes an employer identification number or EIN is also known as a taxpayer identification number or TIN.

Is EIN and Tax ID the same. The federal work authorization user identification number also known as EEV User Identification Number or E-Verify Company ID number is the number. Number or Tax ID.

There is no real difference between Federal Tax ID. One is given to you by the federal government. Typically individuals who are sole proprietors do not file a business tax return and can use their Social Security number in place of an EIN.

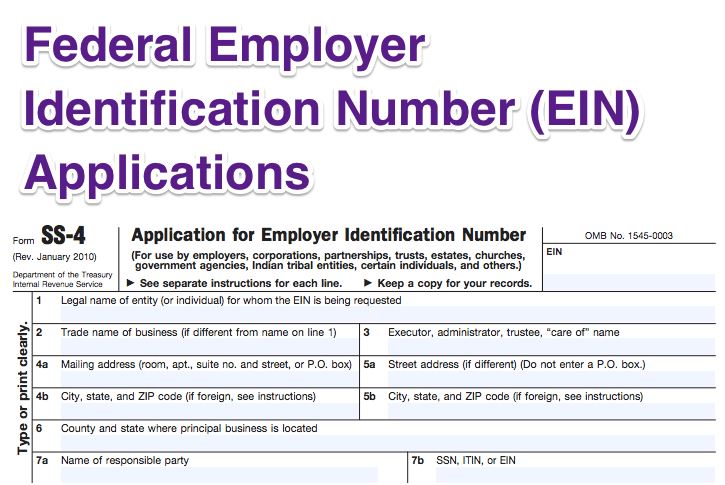

An Employer ID Number EIN is the Taxpayer Identification Number used by corporations partnerships limited liability companies as well as some trusts and other types of organizations. A valid federal employer ID number EIN is nine digits long. In short a state ID number certificate of authority and an EIN number are two different things.

You need it to pay federal taxes hire employees open a bank account and apply for business licenses and permits. If you prefer you can fax a completed Form SS-4 to the service center for your state and they will respond with a return fax in about one week. A sole proprietorship that has no employees and files no excise or pension tax returns is the only business that does not need an employer identification number.

Essentially it is similar to a Social Security Number SSN for an individual but an EIN number is for businesses and entities. A corporate tax ID is interchangeably used with. The Federal ID and the Payers ID are one in the same.

Your business needs a federal tax ID number if it does any of the following. The federal tax identification number is nine 9 digits long and is issued in the following format. If all your authentication information matches you may be issued the same number.

Your Employer Identification Number EIN is your federal tax ID. Yes the payers tax identification number is the same as the federal identification number. If you need to obtain a Tax ID for a state-level purpose ie.

Federal Tax ID also known as EIN or Employer Identification Number is the unique nine-digit number assigned by the Internal Revenue Service IRS to business entities operating in the United States. A Federal Tax Identification Number also known as a 95 Number EIN. March 15 2021 1124 AM.

The Internal Revenue Service IRS uses these nine-digit numbers to identify legal entities such as corporations partnerships estates and non-profits to track their tax obligations. If you do not want to apply for a PTIN online use Form W-12 IRS Paid Preparer Tax Identification Number Application. You can get an EIN immediately by applying onlineInternational applicants must call 267-941-1099 Not a toll-free number.

You must have a PTIN if you for compensation prepare all or substantially all of any federal tax return or claim for refund. FAQ Is an employer ID number the same as a federal tax ID number. Number all refer to the nine digit number issued by.

This number is equivalent to the federal tax identification number or an employment identification number. A tax ID number is a generic term for a nine-digit identification number that the Internal Revenue Service uses to identify and track payments to individuals and businesses for federal. A federal ID number is basically the same as an employer ID number and is a unique set of nine digits formatted 12-3456789 that defines your business as a working tax-paying entity by the Internal Revenue Service IRS within the United States of America.

The other tax identification number is given to you by the state. The terms Employer Identification Number EIN and Federal Employer Identification Number FEIN are often used interchangeably because they describe the same thing.

How Do I Obtain A Federal Tax Id When Forming An Llc Legalzoom Com

What Is An Fein Federal Ein Fein Number Guide Business Help Center

What Is A Taxpayer Identification Number 5 Types Of Tins

What Is Form W 2 W2 Forms Irs Tax Forms Tax Forms

Uk Id Card Template Psd Fake Uk Identity Card In 2021 Id Card Template I D Card Card Template

Letter Ein Confirmation Confirmation Letter Doctors Note Template Employer Identification Number

Ein Number What Is An Ein Number Truic

Difference Between Income Tax Return Informative Different

Obtaining Taxpayer Identification Number Tax Id In Ukraine From 99 Usd Corporate Law Law Firm Tax

Ein Number What Is An Ein Number Truic

How To Apply For A Federal Tax Id Number Cpa Exam Cpa Cpa Review

Electronic Irs Form W 9 2014 Irs Forms Letter Of Employment Certificate Of Participation Template

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

Do Llc Companies Need An Ein Number Legalzoom Legal Info Tax Write Offs Signs Youre In Love Investment House

Making Sense Of Income And Tax Terms Income Employer Identification Number Tax

Posting Komentar untuk "Federal Identification Number Same"