Employment Insurance Deductions 2021

So while you do pay the full premium to the insurance company the net impact on your bottom line is only 50 of the cost once payroll deductions are factored in. If you are self-employed you may be eligible to deduct premiums that you pay for medical dental and qualifying long-term care insurance coverage for yourself your spouse and your dependents.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

The insurance company will bill the employer for the full 300 per month and then the employer will withhold 150 per month from the employees paycheck.

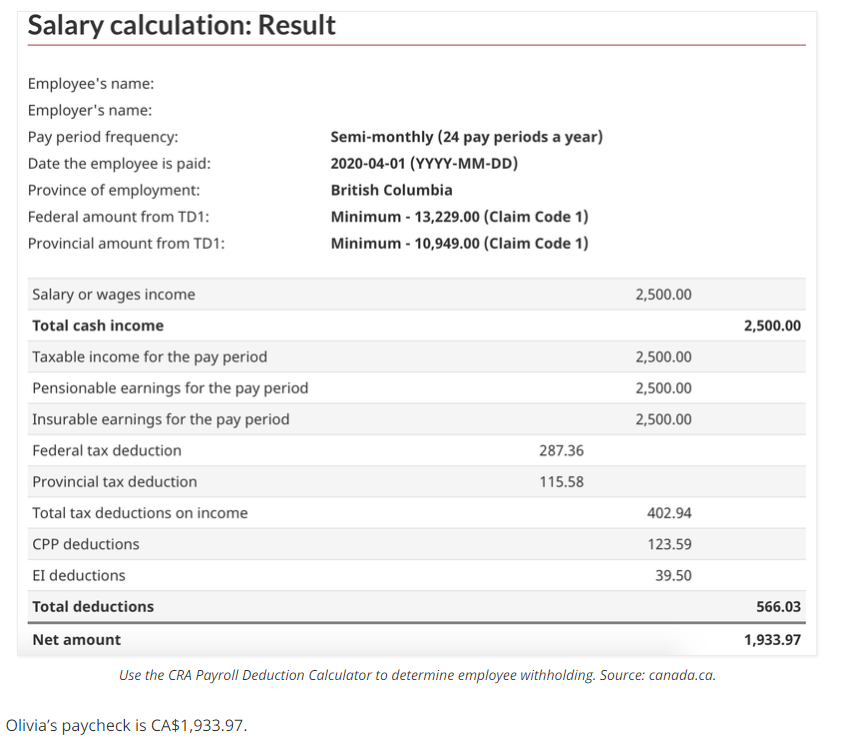

Employment insurance deductions 2021. 120 to 184 520 to 797 a month 18401. If the employer uses a BPAF of 13808 for its employees employees with net income above 151978 can ask for additional tax to be deducted by completing the form TD1. Unless otherwise stated these figures apply from 6 April 2020 to 5 April 2021.

Regular payday on Friday 2 April 2021 tax year 2020 to 2021 but paid on Tuesday 6 April 2021 tax year 2021 to 2022 may be treated for PAYE and National Insurance contributions purposes as. Family coverage will increase 100 to 7100. 25 Zeilen employee premium Maximum annual employer premium.

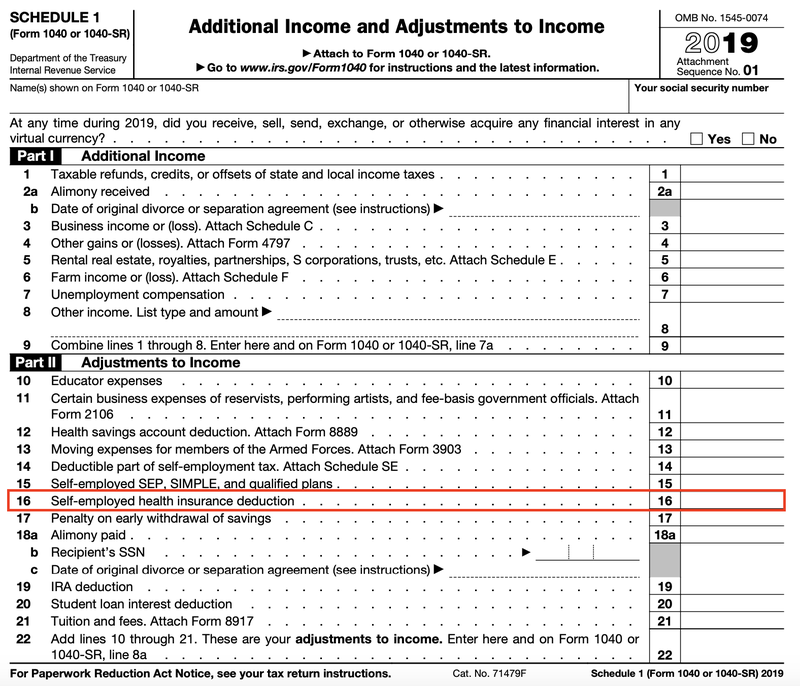

You could still claim your health insurance expenses as a medical deduction on Schedule A if you itemize but the above-the-line adjustment to income for self-employed people is usually more advantageous. 120 per week 520 per month 6240 per year. Employees can roll over funds to the following year and the rollover funds do not count toward that years maximum contribution.

They could end up reducing your total tax bill in April 2021. Employee National Insurance rates. Class 1 National Insurance thresholds 2021 to 2022.

184 per week 797 per month 9568 per year. You can claim a deduction for the cost of premiums you pay for insurance against the loss of your employment income. For 2021 individuals can contribute up to 3600 each year for self-only coverage and 72000 per year for family coverage.

Section A available in both HTML and PDF formats contains general information. Dont miss out on these big self employment tax deductions for 2021. Employment insurance deductions 2021.

4 Total deductions and exemptions add lines 2 and 3. Self-only coverage will increase 50 to 3550. This is known as income protection of continuing salary cover.

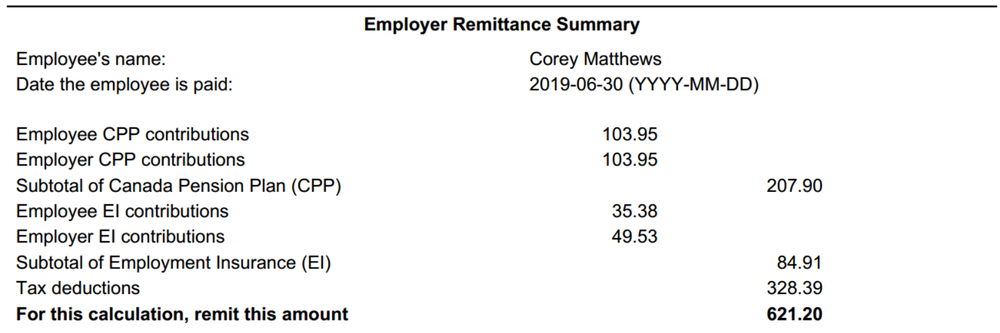

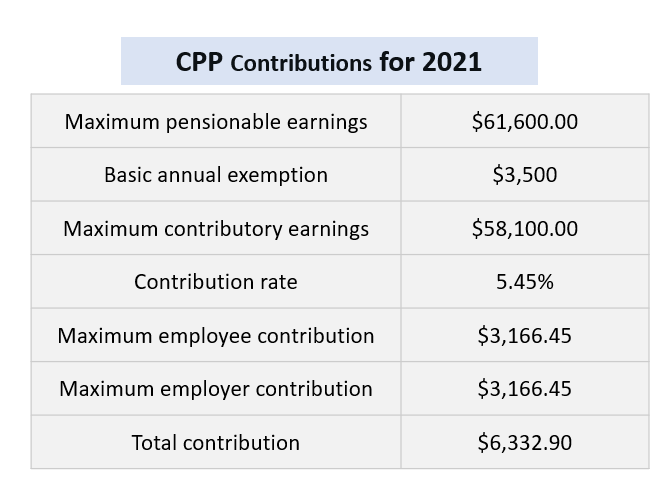

To quickly catch you up to speed your taxes will differ in 2021 in the following ways. Your annual CPP contribution comes to 2534 or 211month. This table shows how much employers deduct from employees pay for the 2021 to 2022 tax year.

PAYE tax and Class 1 National Insurance contributions You normally operate PAYE. Only the premiums you pay to protect your income are deductible. This health insurance write-off is entered on page 1 of Form 1040 which means you benefit whether or not you itemize your deductions.

Deduct the employee contributions before withholding taxes. For 2021 employers can use a BPAF of 13808 for all employees while payroll systems and procedures are updated to fully implement the proposed legislation. Higher Health Savings Account HSA Limits.

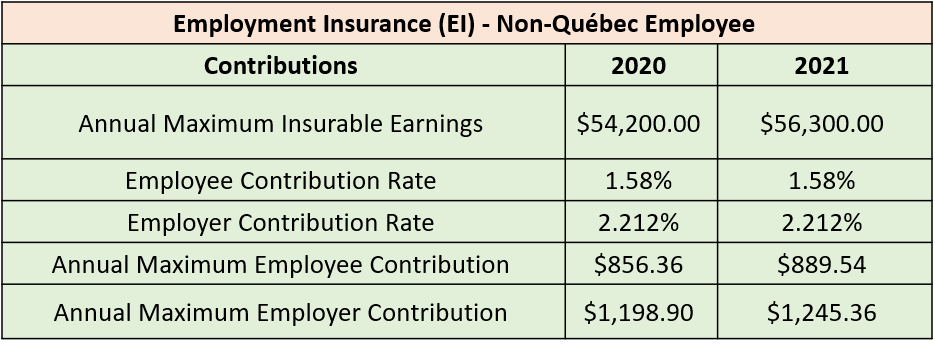

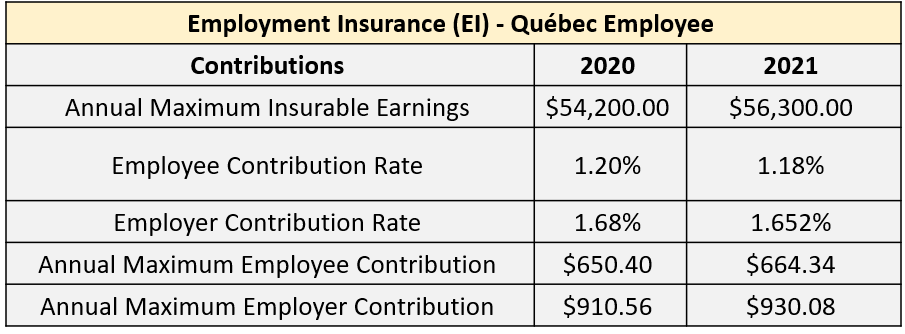

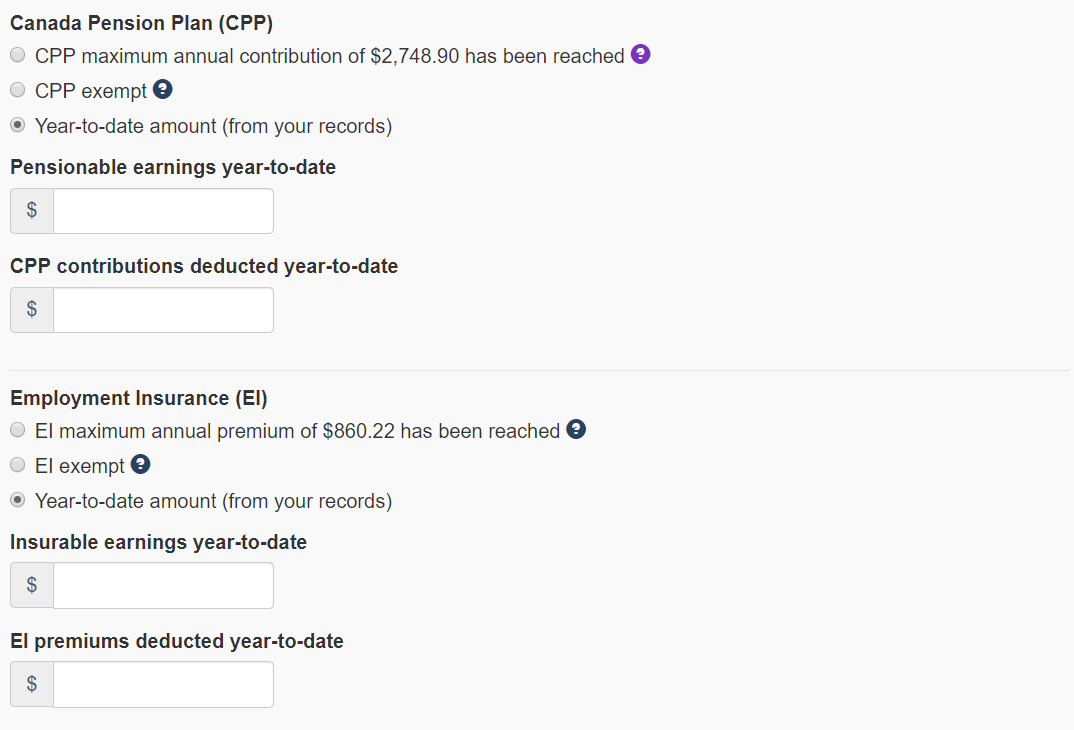

Total amount you remit for EI premiums. You stop deducting employment insurance premiums when you reach the employees maximum insurable earnings 56300 for 2021 or the maximum employee premium for the year 88954 for 2021. Simply Business - Insurance for your business.

They could end up reducing your total tax bill in April 2021. Employers are beginning to tack on a special surcharge of 20 to 50 a month to their unvaccinated workers according to one of the nations largest health benefits consultancies. For Quebec the maximum employee premium for 2021 is 66434.

Publication T4032 Payroll Deductions Tables is available in sections for each province and territory. In 2021 the contribution limit is 3600 for people who have individual coverage under an HDHP and 7200 for those who have family coverage two or more people under an HDHP. You can contribute as both an employee of yourself and as the employer with salary deferrals of up to 19500 in 2020 and 2021 plus a 6500 catch-up contribution if.

Sections B to E available in PDF format only contain the payroll deductions tables for Canada Pension Plan contributions Employment Insurance premiums and federal and Ontario provincial tax deductions.

What Are Payroll Deductions Mandatory Voluntary Defined Quickbooks

What Is The Self Employed Health Insurance Deduction Ask Gusto

Everything You Need To Know About Running Payroll In Canada

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Self Employed Health Insurance Deduction Healthinsurance Org

How Do Employer Health Insurance Contributions Work Gusto

Everything You Need To Know About Running Payroll In Canada

Https Www Willistowerswatson Com Media Wtw Insights 2021 04 Highlights Of The 2021 Federal Budget Pdf Modified 20210420134641

Benefits Elk Grove Unified School District

Worthwhile Canadian Initiative Do The Self Employed Opt Out Of The Canada Pension Plan

Self Employed Health Insurance Deduction Healthinsurance Org

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

A Beginner S Guide To S Corp Health Insurance The Blueprint

Everything You Need To Know About Running Payroll In Canada

Everything You Need To Know About Running Payroll In Canada

What Are Payroll Deductions Mandatory Voluntary Defined Quickbooks

6 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor

2021 Federal State Payroll Tax Rates For Employers

100 Deduction For Business Meals In 2021 And 2022 Alloy Silverstein

Posting Komentar untuk "Employment Insurance Deductions 2021"