What Is Gainful Employment For Ssdi

What is Substantial Gainful Activity SGA. In 2021 for example you earn one credit for each 1470 in wages or self-employment income.

Navigating Employment And Ssi Ssdi Benefits Ppt Download

Social Security Disability Insurance SSDI employment supports can help you protect your cash and medical benefits while you work.

What is gainful employment for ssdi. What Is Substantial Gainful Activity. Substantial Gainful Activity SGA Specifically if you can engage in what the Social Security Administration SSA calls substantial gainful activity SGA you wont be eligible for SSDI benefits. The SSA defines the substantial part of substantial gainful activity as being competitive work.

If an individual makes less than the. When this occurs the excess will be regarded as a subsidy rather than earnings. Social Security uses the term substantial gainful activity SGA to describe a level of work activity and earnings.

An employer may subsidize the earnings of an employee with a serious medical impairment by paying more in wages than the reasonable value of the actual services performed. My countable income is calculated at the end of the year based on AGICan you cover any considerations that could be made for 2021 based on Covid19. Substantial gainful activity is generally work that brings in over a certain dollar amount per month.

For the tables of SGA earnings see DI 10501015. Hello Paulette Im a current SSDI beneficiary. The substantial gainful activity SGA is the level of salary that can be earned that allows an individual to qualify for Social Security disability benefits.

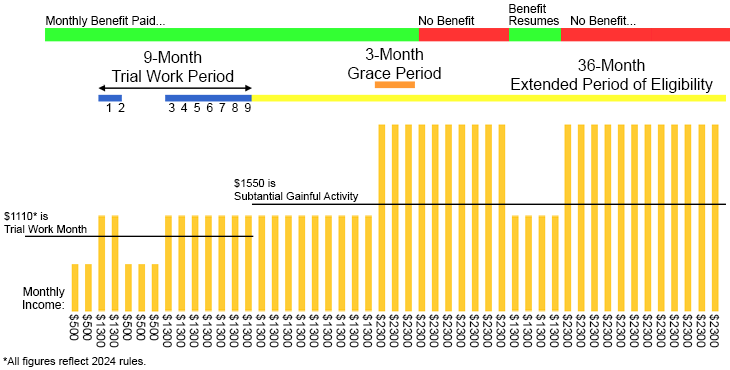

When your benefits end because of your work and you have to stop working later employment supports can make it easy to begin receiving benefits again. Full-time and part-time work may be. A person who is earning more than a certain monthly amount net of impairment-related work expenses is ordinarily considered to be engaging in SGA.

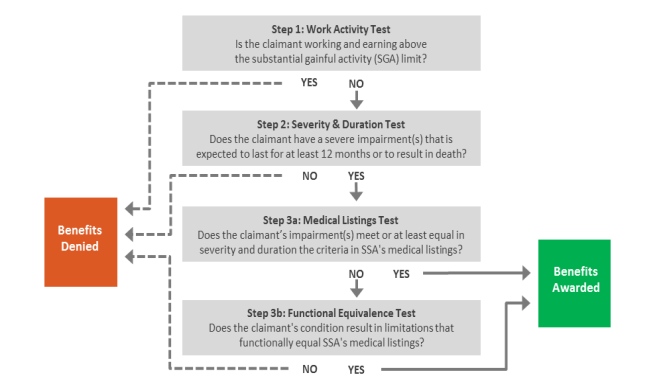

To be eligible for disability benefits a person must be unable to engage in substantial gainful activity SGA. My SGA allowance is 1260month. I have been allowed under The Cares Act to receive Pandemic Unemployment Assistance normally self.

A disabled child also qualifies for the SSI employment supports described later in the Red Book. A person who earns more than a certain monthly amount is considered to be engaging in SGA. Work is substantial if you have to do significant physical or mental activities to carry out your tasks.

If you are able to work in any gainful employment there is a higher possibility that your insurance company will deny your benefits. Your disability prevents you from working in any gainful occupation for which you are reasonably suited considering your education training and experience. Social Security Disability Insurance SSDI payments will stop if you are engaged in what Social Security calls substantial gainful activity SGA as its known is defined in 2021 as earning more than 1310 a month or 2190 if you are blind.

Background Section 4041574 b 2 of agency regulations requires us to determine countable earnings from work activity as substantial gainful activity SGA if they average more than the SGA threshold amounts. If you receive SSDI Social Security uses SGA to decide if your eligibility for benefits continues after you return to work and complete your TWP. You should view all of the SSDI employment supports as a total.

In 2021 that amount is 1310 for non-blind disabled SSDI or SSI applicants and 2190 for blind SSDI applicants. I also perform work as a ridesharing partner. The amount needed for a work credit changes from year to year.

You can earn up to four credits each year. What is a UWA. We use the term substantial gainful activity to describe a level of work activity and earnings.

A UWA is an effort to do work in employment or self-employment which you stopped or reduced to below the substantial gainful activity SGA level after a short time six months or less because of your impairment or the removal of special conditions related to your impairment that you need to help you work. Social Security uses the term substantial gainful activity to describe certain levels of work activity volunteering and earnings. This means the kind of work where workers are expected to work normal shifts full-time and meet productivity or performance standards where there is no particular accommodation for disability.

Social Security work credits are based on your total yearly wages or self-employment income.

Social Security Disability Insurance Ssdi And Supplemental Security Income Ssi Eligibility Benefits And Financing Everycrsreport Com

After Trial Work Period American Dream Employment Network

Social Security Disability Insurance Ssdi And Supplemental Security Income Ssi Eligibility Benefits And Financing Everycrsreport Com

Https Www Disabilityrightsca Org System Files File Attachments 552201 Pdf

Https Hdi Uky Edu Wp Content Uploads 2020 01 2020 Ssdi Self Employment Fact Sheet Pdf

Db101 California Social Security Disability Insurance Ssdi Example Work Rules Focus

What Is The Difference Between Ssi And Ssdi Disability Quora

Https Hdi Uky Edu Wp Content Uploads 2021 01 2021 What Is Substantial Gainful Activity Pdf

What Is Social Security Disability Ssdi Riddle Brantley

Navigating Employment And Ssi Ssdi Benefits Ppt Download

What Is Substantial Gainful Activity 2019 Limits Explained

Substantial Gainful Activity When Applying For Ssdi Benefits Johnson Gilbert P A

Https Hdi Uky Edu Wp Content Uploads 2021 01 2021 Extended Period Of Eligibility Fact Sheet 1 Pdf

Substantial Gainful Activity Disability Benefits Help

Https Www Leapinfo Org Files Resources 2019benefitoverviewssi Ssdi Ssdacpublish Pdf

Substantial Gainful Activity And Your Ssdi Claim The Law Offices Of Martin Taller

Posting Komentar untuk "What Is Gainful Employment For Ssdi"